Car Loan Process Malaysia

Enter down payment amount in Malaysian Ringgit. By taking up this loan this individual is tied down to a formal written agreement where the borrower car buyer is indebted to pay the loan amount plus interest to the lender banks financial agents etc over a specified period of time.

Car Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

This includes the likes of.

. Enter loan interest rate in Percentage. Loans enable you to hold on to your cash in hand by charging you an interest over a certain period of time. Decision was made and like we have done over the last 25 years we started enquiring about.

For example to buy a car with a net worth of RM59993 the officer has a maximum loan eligibility of. Most bank takes a few days to complete the process. In Malaysia you may take out a car loan for a minimum of 1 year to a maximum of 9 years.

For further information about car. If you can afford to put down a bigger down payment you stand to save more on interest fees. In Malaysia car loan tenures can take up to 5 7 or even 9 years.

Compare and calculate your monthly repayments on Loanstreets car loan calculator and save more than RM100 every month. As the name implies car loans in Malaysia is a category of loan taken by a borrower for the specific purpose of buying a car. Enter car price in Malaysian Ringgit.

Youre buying your first car and are applying for a car loan but what are the documents that you need to prepare beforehand. In order to complete the basic steps of registering your car applying for a loan and applying for road tax and insurance youll most likely need. First of all you need to know how much your monthly and annual income is because this is one of the most basic eligibility requirements.

When you buy a car the. - If its RM65000 - an approved loan is RM59900. Depending on your loan amount and interest rate employed your monthly repayments will be bigger for shorter-tenured loans.

The process of getting an approval for a car loan typically takes one to two days. Find out what documents are needed when you apply for a car loan in Malaysia. If you are a first time car buyer this is usually classified as hire purchase loan.

The Complete Car Loan Process With Documentation In Malaysia. Once youre all set on getting the car of your choice its time to take on the legal papers and official documentation. Generate principal interest and balance loan repayment table by year.

A car loan in Malaysia is a type of loan that is taken by an individual for the sole reason of buying a car. When it comes to getting approved for car loans with decent terms a good credit score is key. To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application.

Enter car loan period in Years. If its RM55000 an approved loan is RM55000. In July 2021 we were ready to purchase a new car.

You need at least RM2000 gross monthly salary for a car loan in Malaysia. 1 Buyer choose model 2 Contact car seller arrange for appoinment 3 Ready all required documents 4 Appointment with consultant at your door step 5 Documents submitted for loan processing 1 2 working days. Car loan or financial service providers include banks and.

Once the application and documents are submitted it is up to the bank to decide on the approval of your car loan. Shopping for a car loan for your new or used car. Find a competitive interest rate for your hire-purchase from 18 banks in Malaysia.

Most banks provide hire purchase loans. 37 rows Shariah-compliant car loan package from Maybank based on the principle of Ijarah Thumma Al-Bai. Below is a summarised diagram of a typical car loan application process in Malaysia.

Your credit history the speed at which you can provide adequate documentation verifying your identity and your. Car loans vary from bank to bank so be sure to compare as many as you can. Relax as it is actually not that complicated.

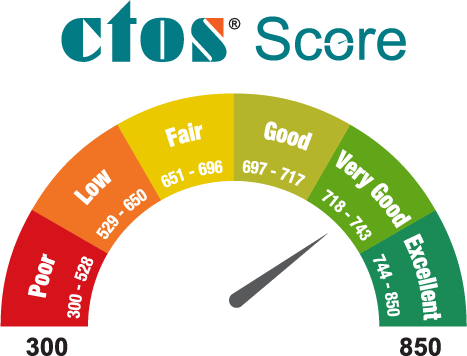

Established in 1990 CTOS is Malaysias leading Credit Reporting Agency CRA under the ambit of the Credit Reporting Agencies Act 2010. Here is the procedure and steps or flow when you buy a new car in Malaysia. With the exception of boat or bike loans the loan amount should be rounded to the lower hundred ringgit amount.

Generate principal interest and balance loan repayment chart over loan period. You may apply for a car loan by visiting any bank of your choice. Be sure to take along all necessary documents which may differ from bank to bank to help speed up the application process.

In Malaysia most commercial banks offer hire purchase loans. Procedure To Appy Loan To Buy A Car. You can also use loan calculators to check the rates according to the price of the car down payment interest rate and salary.

Good FICO Scores range between 670 and 739 and a score of more than 739 is considered exceptional. Banks might offer a lower interest rate if you opt for a lower margin of finance. By taking up a car loan the borrower is obligated to repay the loan amount plus interest to the lender ie.

A bank in instalments over a period of time.

A Guide To Car Loans Interest Rates In Malaysia

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

The Malaysia Type Of Car Loan Proton April 2022 Tax Holiday Rebate Rm7000 Interest Rate As Low As 2 8

No comments for "Car Loan Process Malaysia"

Post a Comment